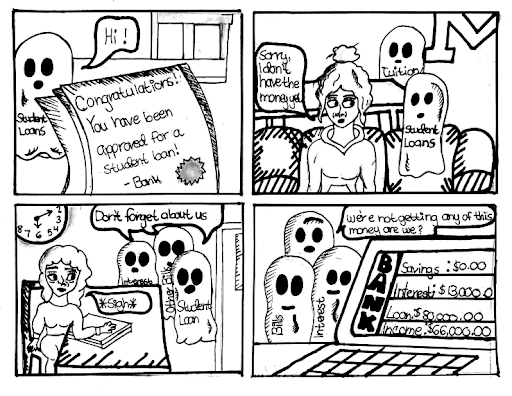

For the 2024-2025 college applicants, the new Free Application for Federal Student Aid [FAFSA] made several key changes, including reducing the number of questions from 108 to 36, expanding the federal Pell Grant qualifications and being more efficient and simple for students and parents. However, some of the eliminated questions, such as the number of people currently attending college in the household, will add to the cost of college for families across the country. This change is supposed to help, not hurt families that wish to send more than one child to college, which according to Education Data.org, can cost around $19,000 a year for four years at an in-state public school. This high price is not easily afforded by many families, as the average household income according to the US Census Bureau is only $74,580 dollars a year. Because of this, students would need more financial aid to even consider attending college.

On-campus jobs can seem to be a good source of income to help pay for tuition while also having the flexibility of not having to commute to another job off campus and shorter working hours.. However, according to The College Investor, the average federal work-study only pays between $3,000 and $5,000 dollars annually, meaning that you can only make a dent in the student debt accumulated throughout the semester. Therefore, many students turn to part-time, full-time, or even multiple jobs just to afford tuition. If colleges want their students to thrive academically without the shadow of student loans following them around for the rest of their lives, then colleges need to lower tuition prices for students.

Colleges should lower their tuition so that alumni would not have to sacrifice a large percentage of their pay towards paying back loans. According to CNBC, a newly employed college graduate only earns around $56,000 a year. When you consider other bills, food, rent, emergencies and insurance, college grads aren’t making enough to balance the necessities to live and pay a large amount of debt each month.

When rent, food, and other necessities that are needed to survive have increased in cost over the years, students also need to take into account the cost of living at any kind of college. This is especially true if they choose to live on campus which on average can cost $11,520 according to Education Data.org. This means that those who decide to go to college must also choose wisely when it comes to either being a commuter student or bearing the cost of living on campus.

One of the major things that people have to decide when going to college is the effect it may have on finances. If colleges were to create renewable scholarships many more students could attend college without the fear of unpaid loans. Those from lower-income, minority and first-generation backgrounds would have more incentive to attend college without worrying about potentially defaulting on loans. If colleges lowered the price of tuition, then more students would be able to afford and attend without student loans following them through their lives. Financial aid can be beneficial but may not entirely cover high tuition rates. With better financial packages more people can afford and attend college no matter what their financial situation may be.