National inflation reaches Student Union: Increased prices follow economic trends

Photo credit: Grace Cueter

October 13, 2022

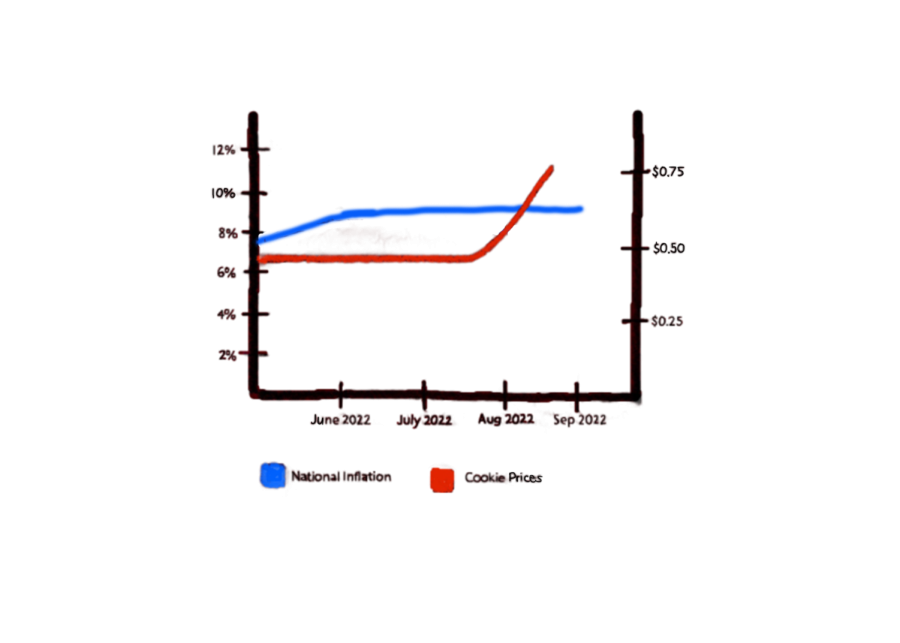

Over the past year, we have watched the cost of food, housing, utilities, gasoline and other goods skyrocket. According to TIME Magazine, as of August, the consumer price index has increased 8.3%, a 40-year high. When the COVID-19 pandemic slowed supply chains and deliveries, it left lasting effects on the economy. Many items are in short supply and the cost of shipping is continuing to increase, forcing the prices of many goods to increase.

While the cost of goods has increased, salaries have not, causing the increased prices of many necessary items to feel out of reach for many individuals and families. Economics teacher Brian Degnore notes that the upturn of inflation is something that many should be wary of, as it has the potential to negatively affect daily lifestyles.

“It impacts people mostly with groceries and gas,” Degnore said. “It hurts people, because people’s paychecks are remaining the same but to get the same amount of goods it’s costing them more and more.”

The price increases can be traced down to the school. Students saw the costs of goods in the Union change at the start of the 2022-2023 school year. While the price of many items, including chips and beverages were upped, senior Lia White feels that the most shocking change was the cost of the union cookies.

“The only real increase I noticed was in the cookies, since they went up from 50 cents to 75 [cents],” White said. “It’s not a big jump but it felt kind of surreal because they were 50 cents the last three years I’ve been at North.”

Although the price jump may seem significant to some students, Student Activities Director Peggy

Bonbrisco notes that the increased cost of the goods and resources is reflected in the Union prices. She is afraid that the increase will hinder sales, therefore decreasing the amount of money that is given to each class at the end of every year.

“We divide up all our proceeds between the four classes and Student Association every year at the end of the year so I want to give the biggest check I can each year to your classes,” Bonbrisco said. “I am worried about that if we aren’t going to sell as much.”

While inflation is a trend that concerns the public, it is a natural cycle within the economy, and there are a variety of protocols used to reverse prices. Degnore speaks on the use of interest rates during periods of inflation, as the Federal Reserve is utilizing their power to control the increasing cost of goods.

“The Federal Reserve in particular is trying to bring down those prices, by raising interest rates,” Degnore said. “Generally there are two things you can do with money, save it or spend it. When the Federal Reserve raises interest rates, that gives people an incentive to save money. They’re trying to raise it so people will take the money out of the economy and stop spending, so inflation will come down.”

Student interest and sales will always be Bonbrisco’s top priorities when setting the price of products in the Union. She promises to keep costs as low as possible, as she feels she is working for the good of the students.

“I’m going to try to keep [the prices] as low as I can,” Bonbrisco said. “If we start paying lower amounts for goods then those prices will drop back down.”